By: Deroy Murdock

The Inflation Reduction Act (IRA) bears the fingerprints of Democrat senators Chuck Schumer of New York and Joe Manchin of West Virginia. Their 725-page ruin belies its billing, beginning with its fraudulent title. While Americans reel under 9.1 percent year-on-year inflation, IRA neglects the worst price surge since November 1981.

The Penn Wharton Budget Model politely mocks Democrat inflation-reduction claims. “The Act would very slightly increase inflation until 2024 and decrease inflation thereafter,” University of Pennsylvania economists reckon. “These point estimates are statistically indistinguishable from zero, thereby indicating low confidence that the legislation will have any impact on inflation.”

IRA would fight inflation through higher government spending. This is like battling alcoholism with just one more round of drinks.

According to the Committee for a Responsible Federal Budget, IRA would pour $485 billion of high-octane moonshine atop today’s inflationary inferno. This includes:

•$1.5 billion to plant trees

•$9 billion to help rich people buy electric cars

•$60 billion for “environmental justice”

•$64 billion to expand and extend ObamaCare subsidies

•$300 billion in corporate welfare for solar and wind projects, green batteries, carbon capture, and more

IRA also raises taxes by $470 billion, including $213 billion in corporate levies. This is dumb in boom times and idiotic in a recession, in which America is mired after two consecutive quarters of economic contraction — never mind Team Biden’s contradictory linguistic gymnastics. Among these hikes:

•A new 15% corporate minimum tax

•A curbed carried-interest provision

•A boost in crude-oil and imported-petroleum taxes

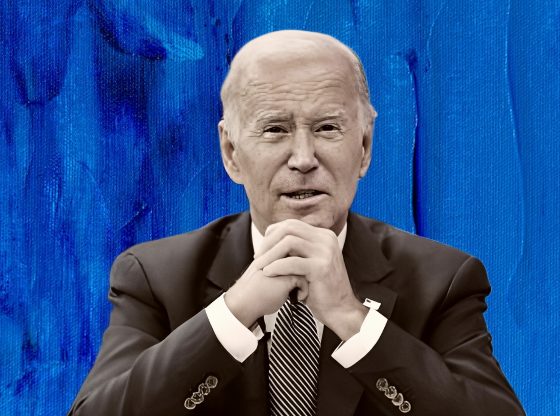

IRA also would break President Joe Biden’s solemn pledge not to raise taxes on those earning under $400,000. The Congressional Joint Economic Committee (JEC) calculates that Americans earning $200,000 or less would pay at least $30.2 billion in new taxes through 2031 — $16.7 billion next year. Those making less than $10,000 can savor an aggregated $323 million tax hike starting in 2023.

Let’s go, Brandon!

The Tax Foundation previews this bill’s potential devastation:

“Using the Tax Foundation’s General Equilibrium Model, we estimate that the Inflation Reduction Act would reduce long-run economic output by about 0.1 percent and eliminate about 30,000 full-time equivalent jobs in the United States. It would also reduce average after-tax incomes for taxpayers across every income quintile over the long run.”

The Foundation added: “By reducing long-run economic growth, this bill may actually worsen inflation by constraining the productive capacity of the economy.”

IRA also would pump $124 billion into tax enforcement including $80 billion to double the Internal Revenue Service’s headcount. IRS last year answered just 10% of its phone calls. Largely ignoring this mess, some 87,000 new inspectors instead would investigate, audit, and litigate the returns of not just Elon Musk and Mark Zuckerberg, but you and yours.

Why?

That’s where the money is.

Citing JEC, the Wall Street Journal editorialized on Wednesday: “…from 78% to 90% of the money raised from under-reported income would likely come from those making less than $200,000 a year. Only 4% to 9% would come from those making more than $500,000.”

Even worse, IRA’s “most damaging component by far remains its impact on health,” argues University of Chicago economics professor Tomas J. Philipson. This bill would empower Medicare to dictate drug prices. Impertinent pharmaceutical companies could charge more. But that would trigger a tax of up to 95 percent. This would strangle life-saving innovation.

Consequently, Philipson writes in Newsweek, “Over the next 17 years, the bill would reduce drug industry research and development by about $663 billion, resulting in 135 fewer new medicines. This will amount to a loss of 330 million life-years, about 30 times the loss from COVID-19 so far.”

In short, the Inflation Reduction Act would leave Americans poor, oppressed, sick, and dead.

Nauseated? If so, please ring the U.S. Capitol switchboard at 202-224-3121. Tell your senators and other lawmakers to deflate the Inflation Reduction Act. Just one Democrat No vote would avoid this catastrophe.

Manhattan-based political commentor Deroy Murdock is a Fox News Contributor. Aaron Cichon contributed research to this opinion piece.

You also can e-mail and fax senators.

Fax?

Yes!

Grassroots activists say that faxes open eyes on Capitol Hill. It’s easy to erase swaths of e-mails. However, it’s impossible to ignore pages spewing from fax machines. If so equipped, fax relevant thoughts to these senators.

Kyrsten Sinema – Arizona

Phone: 202-224-4521

E-mail portal: https://www.sinema.senate.gov/contact-kyrsten

Sinema is not up for re-election this year. However, she was the last Democrat to announce that she would “move forward” on this bill. As the late Senator Everett Dirksen (R – Illinois) famously said: “When I feel the heat, I see the light.” Let Senator Sinema feel the heat.

Meanwhile, these senators face re-election in November and, thus, are particularly heat sensitive:

Michael Bennett – Colorado

Phone: 866-455-9866; 303-455-7600

Fax: 720-904-7151

https://www.bennet.senate.gov/public/index.cfm/index.cfm/write-to-michael

Richard Blumenthal – Connecticut

Phone: 202-224-2823

Fax: 202-224-9673

https://www.blumenthal.senate.gov/contact/write-to-senator-blumenthal

Catherine Cortez Masto – Nevada

Phone: 202-224-3542

Tammy Duckworth – Illinois

Phone: 202-224-2854

Fax: 202-228-0618

https://www.duckworth.senate.gov/connect/email-tammy

Maggie Hassan – New Hampshire

Phone: 202-224-3324

Fax: 202-228-0581

https://www.hassan.senate.gov/contact/email

Mark Kelly – Arizona

Phone: 202-224-2235

Patty Murray – Washington

Phone: 202-224-2621; 866-481-9186

Fax: 202-224-0238

Rafael Warnock – Georgia

Phone: 202-224-3643

Fax: 770-953-2678