Anheuser-Busch’s CEO wants to market its beer as “American made,” rather than “domestic”—the term that typically differentiates U.S. beer from “imports.” However, Anheuser-Busch isn’t really an American company.

But maybe it’s time to make it one again.

Anheuser-Busch hasn’t been American owned since 2008. That’s the year the 156-year-old American brewer was purchased by its Belgium-based, European rival, Inbev. The company was renamed Anheuser-Busch Inbev, and is now the largest beer company in the world, selling one in four beers globally.

This globalization might have sounded good on paper, but it was a disaster for Anheuser Busch. In 2008, Anheuser-Busch produced over 100 million barrels of beer in the US and employed over 21,000 people. Today, it produces 60 million barrels and has shed thousands of jobs.

The errors compounded over time. Following the takeover, Inbev imported executives from Belgium and Brazil to run sales and marketing in the US. It didn’t work. Marketing execs canceled partnerships with country music festivals and the Ultimate Fighting Championship and replaced them with techno concerts more common in Europe.

Then came the forced plunge into Stakeholder Capitalism, ESG and DEI. In the U.S., companies historically operated to serve shareholders—i.e., to generate profits. The European model is different. It compels companies to serve all stakeholders, including activists, governments, the environment and non-profits.

Around 2018, that started to change. Wall Street firms like BlackRock, the world’s largest asset manager, began foisting the stakeholder model on U.S. companies. Given its European roots, Anheuser-Busch Inbev quickly went all in.

As the head of U.S. sales and distribution, I felt the changes immediately. Longstanding principles like merit disappeared. Commitments to diversity, equity and inclusion replaced them. A LGBTQ+ advocacy group called The Human Rights Campaign (HRC) monitored progress.

By 2022, HRC required companies to make at least three “public commitments to the LGBTQ+ community,” including lobbying, donating to LGBTQ+ charities and favoring LGBTQ+ suppliers. If companies disobeyed, they lost their perfect HRC scores.

Brands felt compelled to act.

But as Bud Light soon learned, there was much more than an HRC score at stake.

On April 1, 2023, the most popular beer in America, Bud Light, entered into a disastrous social media partnership with the transgender activist Dylan Mulvaney. They sent Dylan a commemorative Bud Light can to celebrate Dylan’s 365-day journey of transitioning from a biological male to a female.

The reaction was explosive. Customers boycotted. Celebrities chimed in. Kid Rock was among the first to do so, posting a video of himself shooting Bud Lights with an AR-15 rifle.

Anheuser-Busch’s CEO, Brendan Whitworth, fumbled the response. He neither apologized to loyal consumers for the controversial ad nor stood by Dylan Mulvaney as more progressive customers demanded.

Bud Light was supposed to be “easy to drink, easy to enjoy.” It was the number one-rated beer brand because it was remarkably apolitical. Enjoyed by Democrats and Republicans alike. No more.

Millions of customers ditched Bud Light. The stock price nose-dived. Forty-billion dollars of shareholder value was erased. The company still hasn’t recovered. Bud Light sales are down 40% since the controversy and it is now the number three-ranked beer brand in America.

But it’s not too late for a comeback—if Bud Light returns to its roots. That means returning Bud Light to American owners.

It wouldn’t be an unprecedented move. TikTok is being forced to sell in the US for similar reasons: It is owned by a foreign firm with values antithetical to the US. Is Anheuser-Busch Inbev capturing data of US citizens like TikTok? No. But has it harmed US culture and created job losses? Yes.

And in this case, there’s no need for government intervention, since a sale would be in Inbev’s best interests too. Inbev clearly doesn’t know what it’s doing; a sale would allow it to recoup its losses while entrusting Anheuser-Busch’s future to someone who understands the American market.

New owners could revive the American icon. A group like Warren Buffett’s Berkshire Hathaway or a consortium of private equity firms led by Stephen Schwartzman’s BlackStone could buy the US business for $30 billion to $40 billion.

They could hire an American management team dedicated to making Anheuser-Busch the greatest American comeback story in corporate history.

Start with a media blitz.

Apologize for the failures of past management. Sell a future where beer is fun and apolitical again.

Launch or acquire some healthier, non-alcohol brands to become a total beverage company.

Hire brilliant marketers. Drive sales growth.

Label products “American made” on menus across the country. All Americans can cheers to that.

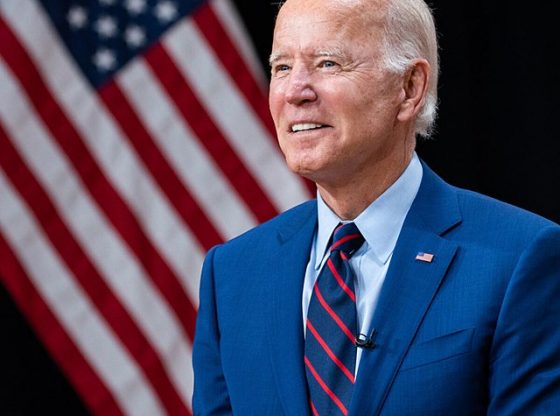

Featured Image Credit: JonClee86.