On Sunday, regulators shut down Signature Bank, a New York-based lender with $110.4 billion in total assets and $88.6 billion in total deposits as of the end of 2022. The closure came just two days after the collapse of Silicon Valley Bank, causing fears that jittery depositors could withdraw their savings from other lenders and destabilize the banking system.

Signature Bank had refused to do business with former President Trump following the Capitol protest on January 6, 2021, due to his alleged encouragement of the rioters and failure to call in the National Guard to protect Congress, despite Trump calling for the protest to remain “peaceful and patriotic.” The bank believed that the resignation of the President of the United States would be appropriate for the peaceful transition of power.

At the time, Signature Bank said in a statement:

“We witnessed the President of the United States encouraging the rioters and refraining from calling in the National Guard to protect the Congress in its performance of duty,”

“At this point in time, to ensure the peaceful transition of power, we believe the appropriate action would be the resignation of the President of the United States, which is in the best interests of our nation and the American people.”

Both Signature Bank and Silicon Valley Bank were heavily invested in volatile cryptocurrency and were advocates of Environmental, Social, and Governance policies, which prioritize woke ideologies over maximizing profits. While federal officials have promised that all depositors of both banks will be made whole and that no losses will be borne by taxpayers, it remains unclear how depositors of Silicon Valley Bank, which is believed to have held massive cash reserves for tech companies, wineries, and venture capitalists, will get their money back. The FDIC insures deposits up to $250,000, but Treasury Secretary Janet Yellen said on a Sunday morning news show that there would be no bailout of Silicon Valley Bank. Other lenders were reportedly asked to bid on taking over the assets of Silicon Valley Bank, but at least one, PNC, declined.

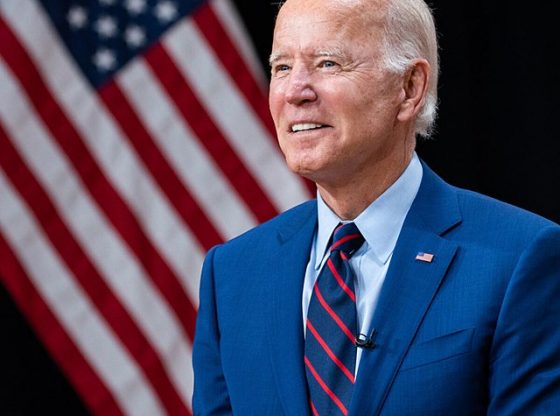

President Joe Biden sought to assure depositors in a speech early Monday that the banking system is safe and that their deposits will be there when they need them. Nonetheless, the collapse of Silicon Valley Bank and the shutdown of Signature Bank have raised concerns among jittery depositors and sparked fears of a larger destabilization of the banking system.