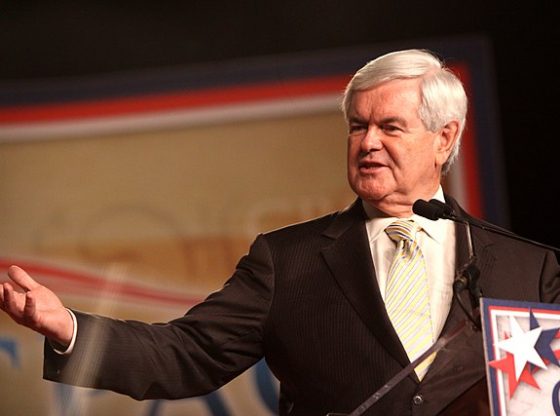

Former Republican House Speaker Newt Gingrich appeared on Fox Business Thursday to discuss what he said was the strategic impact of President Donald Trump’s tax reforms.

House Republicans moved forward with a budget resolution to prolong Trump’s initial term tax cuts that are set to expire at the end of 2025. In an appearance on “Kudlow,” Gingrich explained what he said is the potential of Trump’s tax reforms, especially concerning the revitalization of American manufacturing as he contrasted this approach with the 1981 tax cut, which led to a deeper recession in 1982 as businesses delayed investment until the tax break took effect in 1983.

“As you’ll remember, in the 1981 tax cut, that didn’t go into effect until January of 1983. So 1982, we have a deeper recession, because everybody’s waiting to get the tax break the next year. These guys are very smart about the kind of incentives and, you’ve seen it, by the way, when you look at the number of companies that have already announced that they’re going to invest in America,” Gingrich said.

Gingrich talked about a policy that allows factory constructions to enjoy a 100% expensing benefit.

“The first couple of weeks of the Trump administration, I have no doubt that by the end of this year, if we can get the bill passed by May or June, you will see literally trillions of dollars of commitment to new factories, new jobs, new opportunities, higher incomes, much safer pensions, and, frankly, the ability to pay for Social Security for the foreseeable future. You get up to 3% plus growth. You solve a lot of problems,” Gingrich said.

Highlighting the composition of Trump’s cabinet, Gingrich said it is “the most entrepreneurial, success-oriented, and achievement-oriented” in U.S. history.

“You have an entire cabinet that is the most entrepreneurial, the most success-oriented and the most achievement-oriented cabinet in history. Every single one of those cabinet officers understands where Trump wants to go. They want to go there with him. And so you’re going to have really aggressive, solid cabinet secretaries who are going to work as partners with Musk, not competitors,” Gingrich said. “They’re going to dramatically reshape the government of the United States into a more decentralized, smaller, more efficient and dramatically less fraud-ridden [one]. This is an amazing historic moment.”

Former Reagan economist Art Laffer previously said the country benefited from the tax cuts.

“If I can say one thing here, the taxes did go up with the Tax Cuts and Jobs Act. The rich paid more in taxes at lower tax rates. Revenues went up, not down. And, you know, this was a win, win, win, win. Who on earth would ever want to raise taxes and collect tax rates and collect less revenues? You have to be dumb, blind and stupid to do something like that,” Laffer said.

Featured Image Credit: Gage Skidmore from Peoria, AZ, United States of America