Despite President Joe Biden’s claims of stabilizing the banking industry, it’s clear that his administration’s quick action has not been enough to prevent the collapse of multiple banks. While Biden tried to reassure the public that their deposits would be safe, his comments blaming the Trump administration for rolling back federal regulations only served to deflect responsibility from his own administration’s shortcomings.

Biden’s claims about the Dodd-Frank law preventing bank failures are questionable at best. The fact that Silicon Valley Bank and Signature Bank, which were subject to these regulations, still collapsed shows that these regulations may not be effective in preventing financial crises.

Overall, it’s clear that Biden’s speech was more about political posturing than actually addressing the root causes of the banking failures, as he took note of his “quick action.”

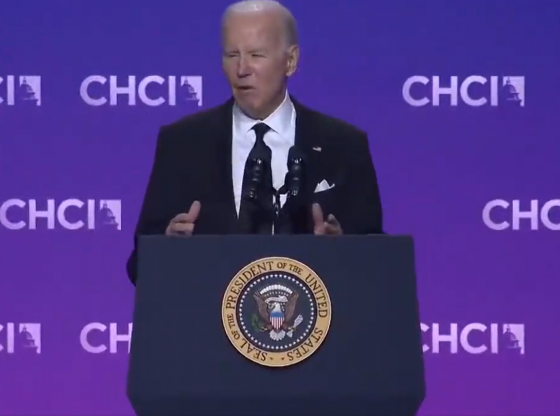

Biden addressed the failures of Silicon Valley Bank and New York Signature Bank on Monday, saying:

“Thanks to the quick action in my administration over the past few days, Americans can have confidence that the banking system is safe,”

“Your deposits will be there when you need them. Small businesses across the country that deposit accounts at these banks can breathe easier knowing they’ll be able to pay their workers and pay their bills. And their hardworking employees can breathe easier as well.”

Biden further emphasized the need for stricter regulations on banks and pledged to ask Congress and banking regulators to strengthen the rules to make it less likely for this type of bank failure to happen again. He highlighted the measures taken during the Obama-Biden administration, including the Dodd-Frank law, to ensure that the crisis seen in 2008 would not happen again. Unfortunately, the previous administration had rolled back some of these requirements, which had contributed to the recent failures.

Biden would go on to add:

“We must get the full accounting of what happened and why those responsible can be held accountable… And my administration, no one is above the law. And finally, we must reduce the risks of this happening again.”

“During the Obama-Biden administration, we put in place strict requirements on banks like Silicon Valley bank and Signature bank, including the Dodd-Frank law to make sure that the crisis we saw in 2008 would not happen again,”

“Unfortunately, the last administration rolled back some of these requirements.”

The Silicon Valley Bank announced a $1.75 billion share sale last week after suffering heavy losses from the liquidation of a $21 billion bond portfolio. SVB is the 16th-largest bank in the United States and lends to nearly half of the venture-backed technology and healthcare companies in California’s Silicon Valley. The Federal Deposit Insurance Corporation (FDIC) said on Friday that SVB was closed by the California Department of Financial Protection and Innovation.

Signature Bank in New York would go on to be closed by state officials on Sunday, prompting a statement from Treasury Secretary Janet Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg. They announced a similar systemic risk exception for Signature Bank and assured depositors that they would be made whole, and no losses would be borne by taxpayers.

Biden’s speech attempted to placate public fears by assuring them that their deposits were secure, but it failed to address the root causes of the recent bank failures. While he talked about stricter regulations, his administration has yet to propose any concrete plans to prevent similar failures from happening again. His focus on accountability seems more like a political maneuver than a genuine effort to find solutions to the underlying issues.