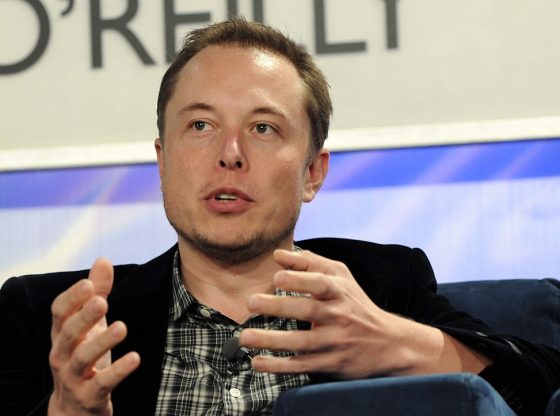

As Elon Musk is busy trying to buy Twitter another shareholder has upped its stake in the company.

The Daily Wire reports:

“Asset manager Vanguard Group recently upped its stake in the social-media platform and is now the company’s largest shareholder, bumping Mr. Musk out of the top spot,” The Wall Street Journal reported. “Vanguard disclosed on April 8 that it now owns 82.4 million shares of Twitter, or 10.3% of the company, according to the most recent publicly available filings with the U.S. Securities and Exchange Commission.”

The report comes the same day Musk officially offered to buy social media giant Twitter and take it private for a jaw-dropping $43 billion dollars. [Related: Analyst Predicts Twitter Will Cave After Elon Musk Makes Stunning Offer to Buy Company and Take it Private to Bring Back Free Speech]

On the same day Musk also admitted during a TED Talk that he does have a backup plan if he doesn’t succeed in buying Twitter.

According to The Daily Wire:

“If in this case you are not successful in that the board does not accept your offer, you’ve said you won’t go higher, is there a plan B?” Musk was asked.

“There is,” Musk responded while smiling.

When asked what his backup plan is, Musk said he would discuss that at another time.

“I think it’s very important for there to be an inclusive arena for free speech,” Musk said during the event. “Twitter has become kind of the de facto town square, so it’s really important that people have both the reality and perception that they’re able to speak freely within the bounds of the law.”