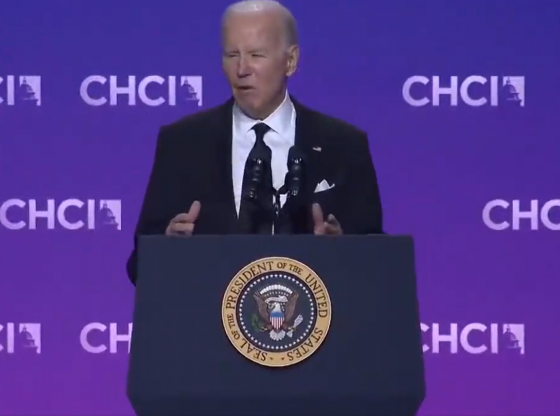

State treasurers and other finance officials from a whopping 27 states have written to President Biden urging him to end his controversial policy of forcing people with good credit scores to subsidize mortgage loans for higher-risk and low-income borrowers. The policy, which is set to take effect today, aims to help lower-income borrowers afford their monthly mortgage payments by unfairly increasing the payments of people with good credit scores – as the extra payments being credited to the loans of higher-risk borrowers.

The bi-partisan group of officials are warning that the policy would be a “disaster,” and criticized it for penalizing hardworking middle-class families and reducing incentives for people who make sound financial decisions and budget properly.

According to Fox Business:

“Biden’s plan was outlined just a few weeks ago by the Federal Housing Agency (FHFA) and is set to take effect today. The plan is aimed at helping lower-income borrowers afford their monthly mortgage payments – it would do so by forcing people with good credit scores to pay more each month for their mortgages, extra payments that would be credited to the loans of higher-risk borrowers.

The state finance officers blasted the plan for turning the normal system of home buying incentives “upside down” by hurting people who make sound financial decisions. The policy will take money away from the people who played by the rules and did things right – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment.”

Financial officials from 27 states stated on Monday that the policy was a mistake prior to its implementation, saying:

“[T]the policy will take money away from the people who played by the rules and did things right – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment,” they wrote. “Incredibly, those who make down payments of 20 percent or more on their homes will pay the highest fees – one of the most backward incentives imaginable.”

“[T]he right way to solve that problem is not to use the power of the federal government to penalize hardworking, middle-class American families by confiscating their money and using it as a handout,” they wrote. “The right way is to implement policies which will reduce inflation, cut energy costs and bring lower interest rates.”

It remains to be seen whether President Biden will heed the warnings of state treasurers and other finance officials from 27 states and end his controversial policy of forcing people with good credit scores to subsidize mortgage loans for higher-risk borrowers. These officials suggested implementing more rational policies that reduce inflation, cut energy costs, and bring lower interest rates as a better solution to expand homeownership, as these Americans would be spending less money on essentials, making it easier to afford a mortgage.