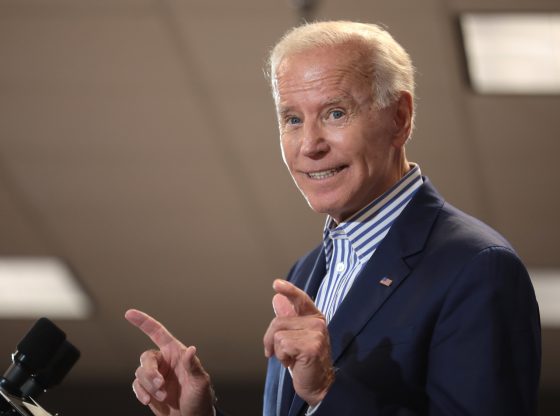

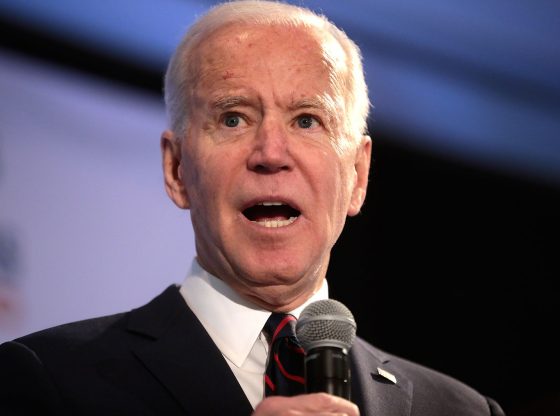

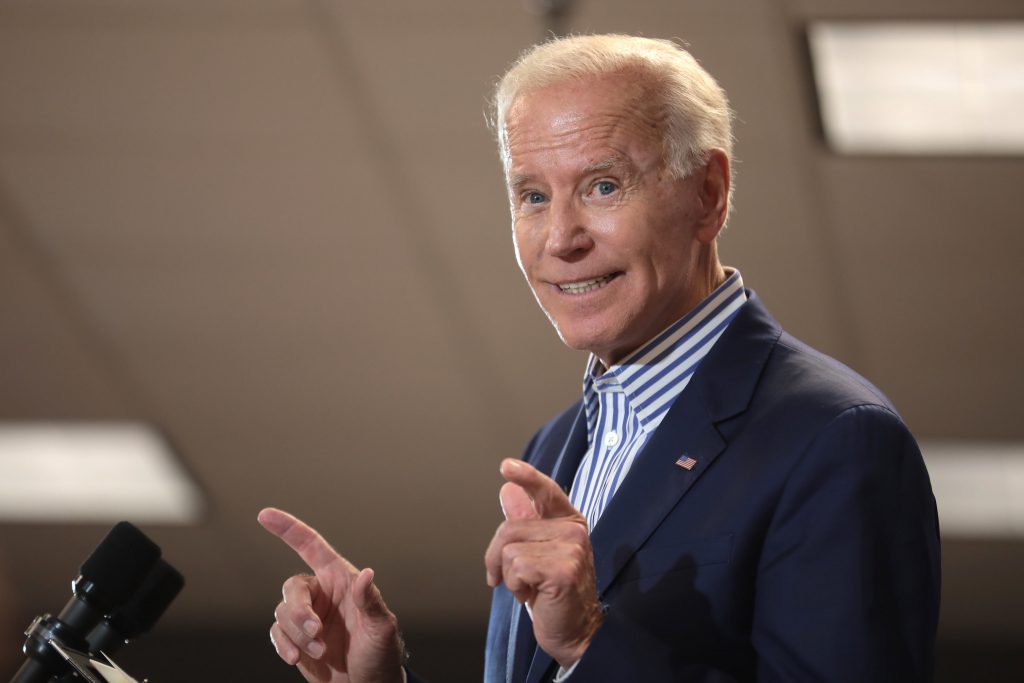

Increase Levies on Inherited Assets

President Biden’s spending plan also seeks to completely eliminate levies on inherited assets.

According to Fox Business:

Under current law, when heirs inherit an asset that has appreciated in value, they get a “step-up” in basis, meaning they receive the holding at its current market value. Beneficiaries can sell those assets and pay capital gains based only on the time they receive the asset and the time they sold it, allowing them to minimize the tax bite.

The first $1 million of gains would be exempt from the end of the stepped-up basis, and there would be no tax if the gains are used for charitable donations.